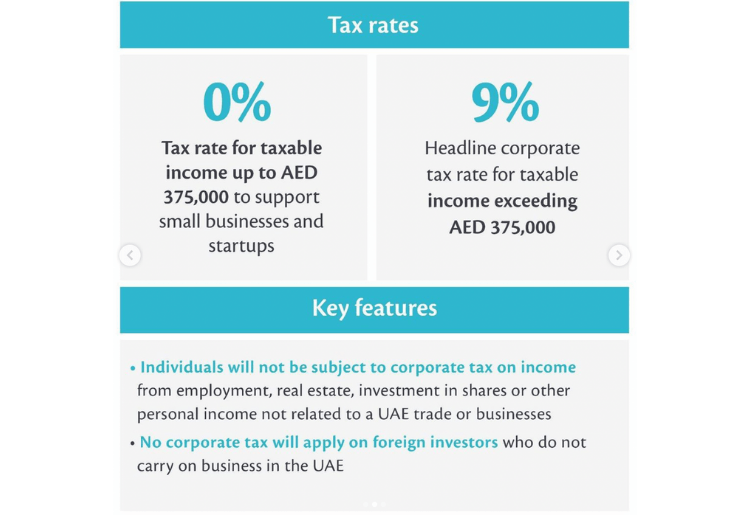

The UAE has confirmed the implementation of a federal corporate tax on business earnings beginning June 1, 2023. Small firms and startups with a profit of up to AED375,000 will be exempt from paying tax.

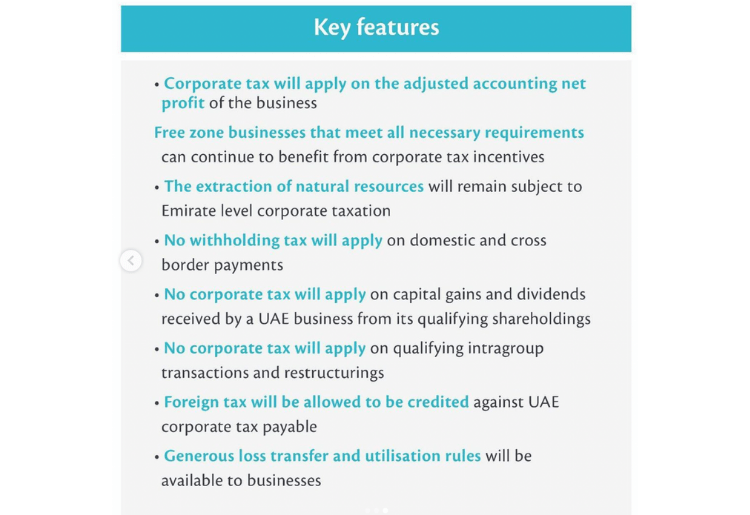

Companies having an ‘adjusted accounting net profit’ of more than AED375,000, on the other hand, will be subject to the ordinary statutory tax rate of 9%. The levy will only apply to UAE enterprises — it’s not a personal tax.

The proposed corporate tax will apply to all firms and commercial operations, except the “extraction of natural resources” like oil and gas, which will continue to be subject to Emirate-level corporate taxes.

FOLLOW US ON OUR SOCIALS